Table of Contents

What is ChargeOn?

ChargeOn is a native platform for payment processing in Salesforce. It connects Salesforce CRM directly with more than 14 leading payment gateways, including Stripe, PayPal, Authorize.net, etc., making it easier for businesses to receive payments without leaving the CRM. You don’t need any third-party plugins, custom APIs, or middleware platforms to receive payments in multiple currencies. This makes it an ideal solution for Salesforce payment processing use cases across industries.

Built on a centralized data model, ChargeOn gives Salesforce users full control over their payment lifecycle from successful transactions to notifying them about failed ones. All payment activity is recorded and accessible within Salesforce records. It allows real-time reporting, automation, finance management, and cross-functional collaboration across sales, finance, and support teams.

ChargeOn is available on Salesforce AppExchange, the trusted marketplace for Salesforce-based solutions. Designed for quick deployment and compatibility with Sales, Service, and Experience Cloud, it requires minimal configuration to get started.

The tool meets the rigorous security standards as mandatory for AppExchange listing, making it secure for payment handling and giving businesses confidence to accept payments right inside their CRM.

Check out the live demo of ChargeOn, showcasing how it Automates and manages Payments Natively in Salesforce.

Let’s have a more specific and in-depth understanding of its features, benefits, and use case.

How Does ChargeOn Process Payments in Salesforce?

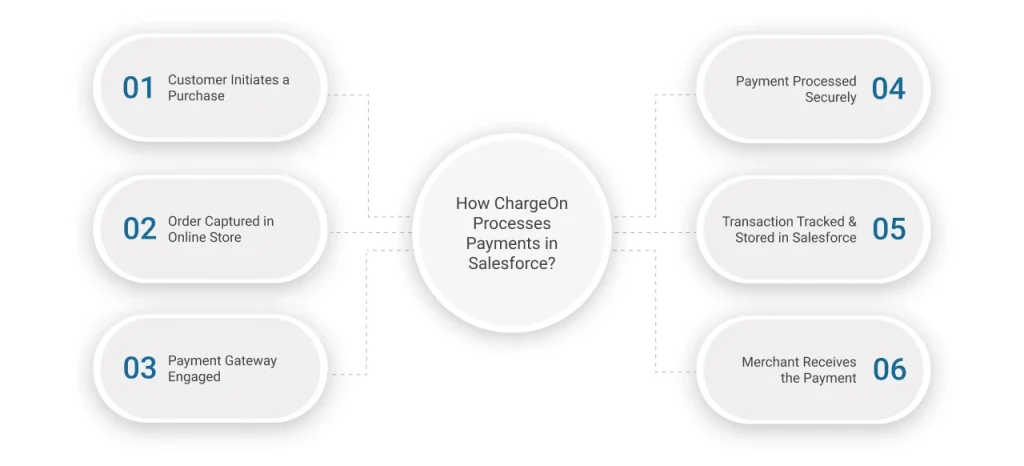

ChargeOn simplifies Salesforce payment integration with a payment gateway by embedding the entire transaction lifecycle directly inside Salesforce. Here’s a step-by-step explanation of how the entire process works in simple terms:

1. Customer initiates a purchase

It all starts with a customer, someone who’s ready to buy a product or service. This could happen through your website, a sales call, or any platform that connects with your Salesforce system.

2. Order Captured in Online Store

The customer adds items to their cart and places an order on your online store. This order is automatically captured in Salesforce, where all your customer and transaction details are stored.

3. Payment Gateway Engaged

Once the order is confirmed, ChargeOn starts playing its role. It securely passes the payment information (like card or bank details) to the payment gateway of your choice, such as Stripe, Fat Zebra, Recurly, ChargeBee, etc. This is the tool that processes the money transaction.

4. Payment Processed Securely

The payment gateway checks if the payment can be made (e.g., if there’s enough balance or if the card is valid). If all looks good, the transaction is processed. This is the step where the money is transferred from the customer’s account.

5. Transaction Tracked & Stored in Salesforce

As soon as the payment is processed, ChargeOn updates the payment status right inside Salesforce. Whether it’s successful, failed, or still pending, your team can see it instantly, no need to switch tabs or systems. If anything fails, ChargeOn can also automatically send reminders or payment links to the customer.

6. Merchant Receives the Payment

Once the payment is complete, the funds are transferred to your merchant account. At the same time, Salesforce records are updated, your team is notified, and the transaction is fully logged, making it easy for sales, finance, or support to follow up if needed.

In short, this enables payment gateway integration with Salesforce to work flawlessly without context switching, making the entire process secure and trackable.

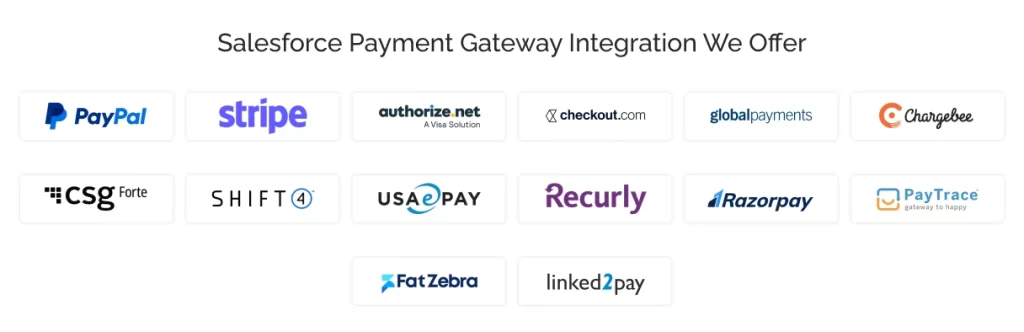

Salesforce Payment Gateway Integration ChargeOn Offers

ChargeOn helps businesses seamlessly integrate with 14+ different payment gateways, which help to simplify Salesforce payment processing:

Rather than handling multiple integrations separately, it provides a single interface that can simultaneously manage payment gateway integration with Salesforce for different providers.

Explore some of the common gateways:

Stripe: Stripe is a popular payment gateway that offers safe, flexible processing, simple integration, and support for multiple currencies and payment methods.

PayPal: PayPal is a trusted payment gateway platform allowing businesses to securely accept payments through bank accounts, wallets, and cards globally. It provides fast access to funds and a seamless customer experience.

Authorize.net: Authorize.net is a secure, flexible, and user-friendly payment gateway enabling global transactions, multiple payment methods, recurring billing, and advanced fraud protection.

Global Payments: Global Payments is a leading provider of financial technology that offers safe and scalable solutions for enabling international management of payments across multiple payment methods and complex workflows.

If your preferred payment gateway isn’t listed here, don’t worry, reach out to our experts, and we will make it happen for you.

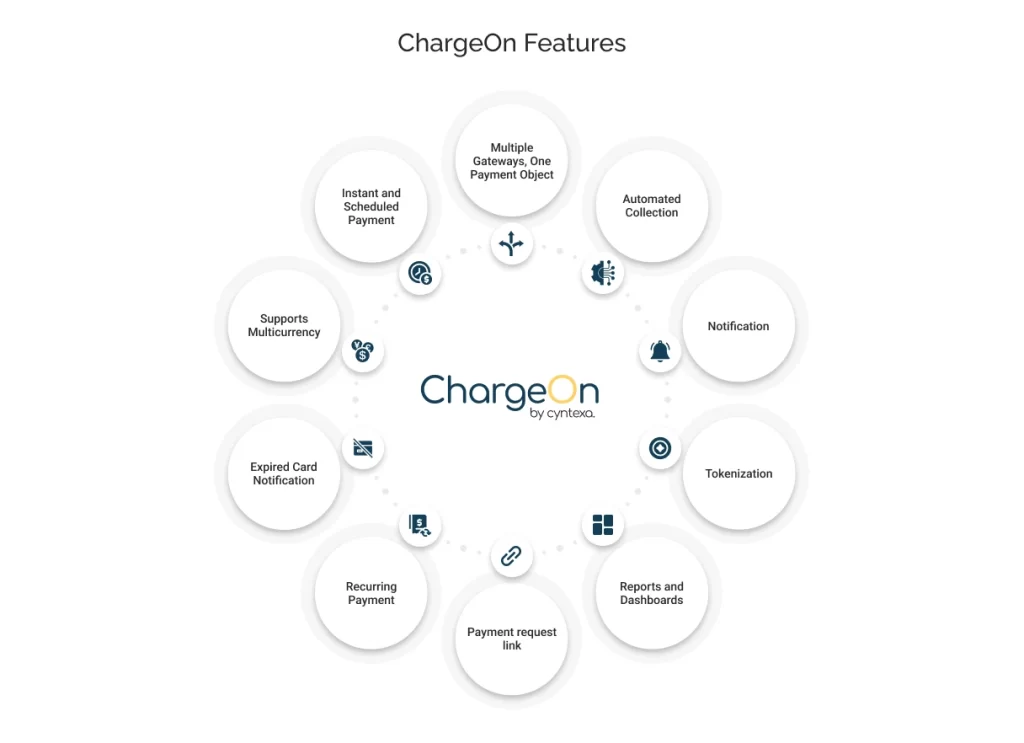

ChargeOn Features

1. Multiple Gateways, One Payment Object

Whether you’re collecting payments against Opportunities, Invoices, or a custom object like “Donations” or “Project Milestones,” ChargeOn gives you the flexibility to map payments to what matters in your CRM. You’re not limited to predefined fields or workflows, and your team also gets full control over where payment data lives and how it’s used.

2. Automated Collection

ChargeOn can be used for the automated collection of payments by monitoring due payments and failed transactions. When payments are missed or fail, ChargeOn automatically retries the collection of payment by a configurable payment schedule. It directly sends payment reminders to customers with easy-to-use payment links. Moreover, it can also seamlessly automate the collection of recurring payments for subscription services inside Salesforce. Customers can update their payment methods as per their choice of credit cards or ACH transfers.

3. Notifications

Whether a payment succeeds or fails, ChargeOn keeps both your internal teams and your customers informed. Automated notifications give the Sales team info when a deal gets closed, Finance gets alerted when payments fail, and customers are notified in real-time.

4. Tokenization

ChargeOn enhances the security of transactions through tokenization. Instead of storing sensitive card and bank info in plain text, the data is encrypted and converted into secure tokens. These tokens are safely used for future transactions, without exposing real financial data.

5. Reports and Dashboards

Want to see which months bring in the most recurring revenue? Or track how many payment failures happen per product line? ChargeOn integrates with Salesforce reporting to give you a unified, visual view of your payment data, turning it into meaningful insights you can act on.

6. Payment Request Links

Whether it’s email, SMS, or WhatsApp, ChargeOn lets you generate and send payment request links using the customer’s preferred communication channel. You don’t need any login portals or additional steps; this tool gives your customers a convenient and secure way to complete their payments.

7. Recurring Payment

ChargeOn lets you set up custom billing cycles (weekly, monthly, quarterly) based on how your business collects revenue. Whether you’re a SaaS company or a subscription-based nonprofit, it keeps the payment flow steady and predictable.

8. Expired Card Notification

ChargeOn keeps track of card expiry dates and automatically notifies customers to update their payment details before a transaction fails. That means fewer service disruptions and fewer calls to your support team.

9. Supports Multicurrency

ChargeOn can help to process the transactions in multi-currency formats of zero, two, or three decimal places. The exchange rates for the currencies are also updated on a daily basis.

10. Instant and Scheduled Payments

This Salesforce-native tool can help your business with one-time purchases or immediate settlements. It can also help you to schedule payments.

It also simplifies payment collection for your subscription-based services and installment plans by triggering payments weekly, monthly, and annually.

How ChargeOn can Simplify the Payment Processing?

ChargeOn is beneficial for simplifying Salesforce integration with payment gateway processes for your business in the following ways:

1. Adaptive Payment Facility:

ChargeOn can adjust the business payments according to the customer preferences, specifically in cases where the use of different online payment methods, like ACH, cards, e-checks, and more, is common.

2. Reduced Security Threat:

ChargeOn assures that confidential customer details can never be interpreted and used by the attacker by maintaining your secret data card as a token.

3. Reduced Burden of Training:

ChargeOn eliminates the dependency on IT teams by giving training support to other teams like sales, service, and finance. This makes your team independent in setting up and handling payment services.

4. Improves Customer Trust:

ChargeOn increases the trust of customers in your business, as it reduces payment delays. It makes your business transactions reliable through enabling error-free, instant, pre-planned, and recurring payment processing.

5. Improves Responsiveness:

ChargeOn provides real-time visibility of the payment activity through notifications. This helps businesses to quickly take suitable actions on delayed and failed payments.

6. Accelerates the Checkout Process:

If customers feel that the checkout process is time-consuming, there are strong chances they will get frustrated and abandon it before paying. ChargeOn avoids this by auto-filling common customer details and enabling a faster checkout.

7. Amplifies International Business Transactions:

ChargeOn supports frictionless global payments, as there is no need to manually convert the currency according to updated exchange rates.

How to Install ChargeOn in Salesforce?

To get started with ChargeOn in Salesforce, follow the steps below:

- Open ‘AppExchange.‘

- In the search bar, enter ‘ChargeOn.’

- Locate the ChargeOn listing and click ‘Get It Now.’

- Post submission of your requirements, our experts will reach out and help you leverage the functionalities of the tool into your CRM.

You can also submit this form directly to get in touch with our team.

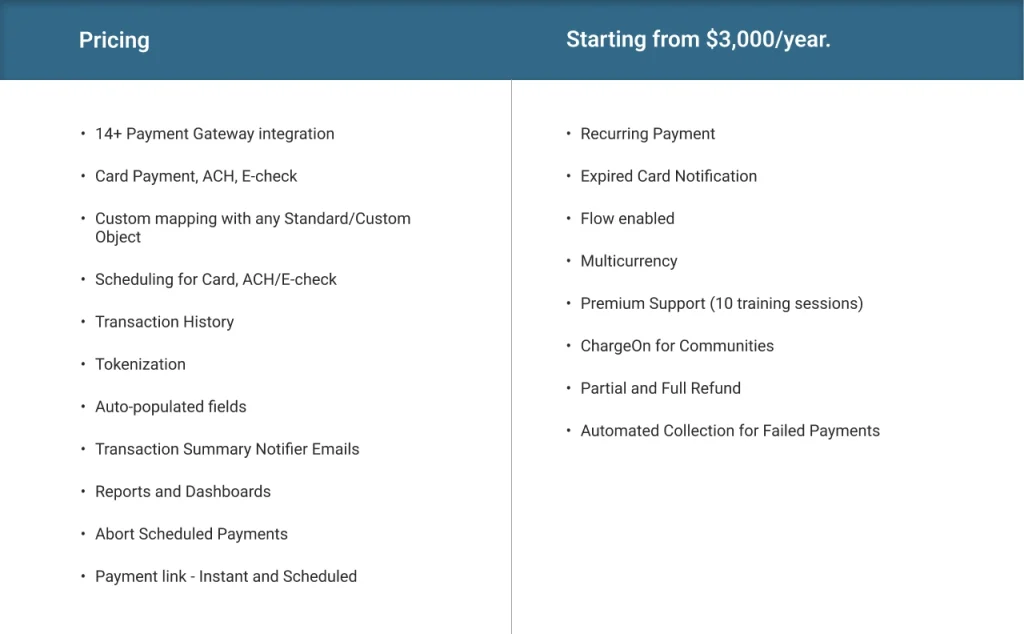

How Much Does ChargeOn Cost?

Seamlessly integrate 14+ payment gateways into Salesforce with ChargeOn — starting from $3,000.

Following is the detailed breakdown of the pricing plan, including what features you will get in this package:

Final Take

ChargeOn is a 100% native Salesforce Application that provides seamless payment gateway integration. It is leveraging state-of-the-art security and flexibility to facilitate payment processing with confidence. With seamless integration to more than 14 payment gateways, it enables businesses to receive multicurrency cross-border payments.

Looking for a Demo to set up ChargeOn for your business? Book your appointment now. Also, connect with us to enjoy a FREE 30-day Trial with no upfront costs.