Table of Contents

Choosing the right payment gateway and processor combo is a crucial decision for every business. One wrong choice can negatively impact your payment ecosystem.

How?

- The hidden fee pitfall

- PCI compliance headaches

- Technical issues

- Integration incompatibility and various other problems.

Additionally, before making the ultimate decision, you should be thoroughly aware of the payment gateway vs. payment processor differences.

After you have understood how these different technologies work, this blog becomes your ultimate guide on how to choose a payment gateway and processor that best suits the needs of your business.

Hence, let’s get started!

How to choose a payment gateway?

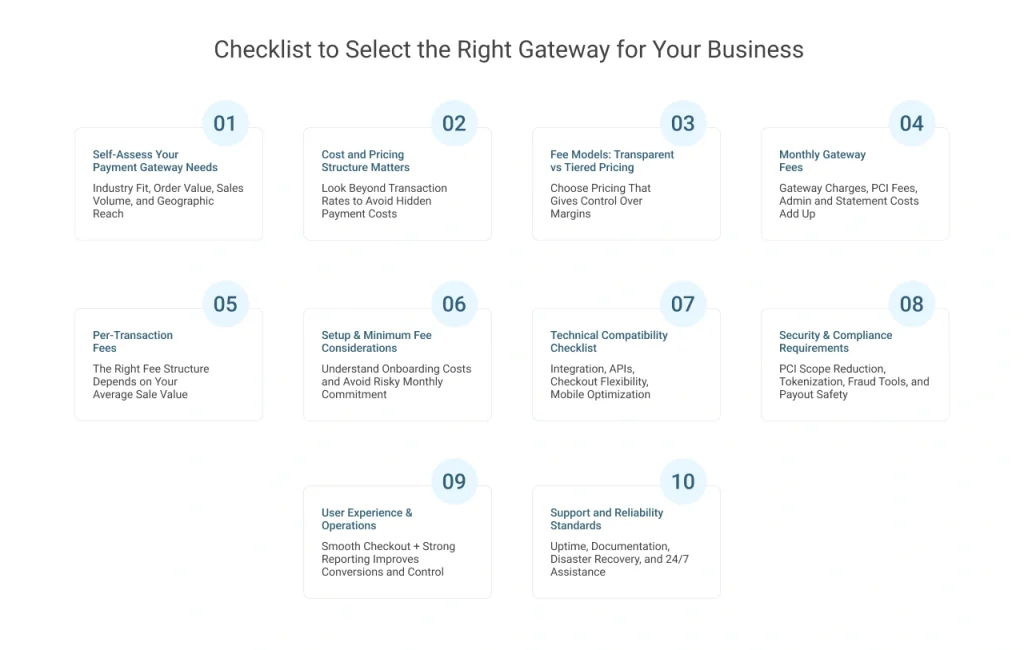

Here, we have provided a checklist on how to choose the right payment gateway for your business.

Self-assess your needs for a payment gateway

Consider your industry and your business model first. This helps you narrow down your options, specifically those that support your industry type and business model.

Look at the average order value and monthly sales of your business. It will help you choose the payment gateway that supports a certain order value and transaction counts. Also, you can judge whether the gateway will be able to scale with growing transactions in your business.

Define your geographic reach, whether you want to sell domestically or want to scale internationally. This decision will help you choose the payment gateway that either has a strong local presence or a global presence.

Cost and pricing structure

When choosing a payment gateway, you must look beyond the advertised transaction rate and evaluate the complete pricing structure. A gateway may appear affordable at first, but it can become expensive due to hidden fees, rigid contracts, or unsuitable pricing models. Therefore, understanding the cost structure helps you predict long-term expenses, avoid last-minute surprises, and choose a solution that aligns with your transaction volume, geography, and growth plans.

Fee models: Transparent or tiered/bundled

Transparent models like interchange-plus clearly separate card network fees from the processor’s markup. This makes it easier to understand where money is going. In contrast, tiered or bundled pricing groups transactions into categories with rates, which can hide extra markups and lead to unpredictable costs. Therefore, choosing a transparent model allows businesses to maintain better financial visibility and control over margins.

Monthly fees

You must carefully examine fixed monthly fees, such as gateway charges, PCI compliance fees, and administrative or statement fees. These are the recurring costs that impact your total spending.

Evaluating fixed fees will help you estimate your baseline monthly cost and determine whether a gateway is financially viable at your current scale.

Per transaction fee

A key factor to consider is the fee for each transaction. This fee is usually a percentage of the sale price, plus a fixed amount per transaction. This is the most noticeable cost, but its effect can differ based on the business model.

For instance, businesses with high-value sales are more impacted by the percentage fee, while businesses with low-value sales but high volume are more affected by the fixed fee per transaction. Knowing this helps you choose a payment gateway that fits your average sale value.

Setup/Onboarding fee

You must also account for setup or onboarding fees, which are often charged as a one-time cost for integration, customization, or technical support. Also, evaluating setup costs as part of the total cost of ownership ensures a more accurate comparison between vendors.

Some gateways impose a minimum monthly fee, requiring businesses to pay a set amount even if transaction volume is low. This can be risky for seasonal businesses or companies in early growth stages. Understanding minimum fee requirements helps businesses avoid financial pressure during low-activity periods and choose more flexible pricing structures when needed.

Technical compatibility with the existing business system

When choosing a payment gateway, you must first evaluate platform integration, ensuring the gateway offers a reliable native plugin or app for your existing e-commerce or CRM platform to reduce custom development, integration risks, and future maintenance issues.

API documentation is important, as well-structured APIs with SDKs for the business’s tech stack enable faster implementation, easier troubleshooting, and long-term scalability.

Ensure that the gateway supports multiple checkout options among hosted, embedded, and headless, to allow flexibility between quick deployment, brand control, and advanced payment flows as business needs evolve.

Test strong mobile optimization, including responsive checkout and native Apple Pay andGoogle Pay support. It is essential to maintain high conversion rates across devices. You should also assess which payment methods, major cards, digital wallets, payment options, and BNPL options are supported, to avoid checkout abandonment and support international customers.

Security, compliance, and risk management

While choosing a Salesforce payment gateway, you must evaluate the security, compliance, and risk management factors.

Start by understanding the PCI compliance level the gateway enables. Solutions that reduce your PCI scope (such as qualifying for SAQ A) lower audit effort, costs, and liability by keeping card data out of your systems.

Data security is equally important. Features like tokenization, strong encryption, and P2PE for in-person payments ensure sensitive card data is never exposed or stored, which reduces breach impact.

The gateway should also provide robust fraud prevention tools, including configurable rules and adaptive detection, to balance fraud reduction and minimal customer friction.

You should also check underwriting and eligibility, meaning whether the gateway supports your industry and payment model without risking sudden account reviews or payment holds later.

Reserve requirements should be clearly understood, as some gateways may temporarily hold a portion of your funds, which can impact cash flow.

Finally, knowing a reliable payout schedule as to how quickly and consistently you receive your money after a payment is essential for smooth operations and financial planning.

User experience and operations

User experience matters when it comes to checkout experiences. You should evaluate the checkout flow of a payment gateway. The number of clicks, form fields, and redirects directly affects conversion rates. Therefore, a smooth, low-friction checkout helps reduce cart abandonment, while the ability to maintain brand consistency builds customer trust during payment.

The gateway’s dashboard and reporting capabilities are equally important. An intuitive interface with strong search, filtering, and export options allows finance and operations teams to track transactions, reconcile payments, and generate reports without manual work or technical dependency.

An optimal gateway has a simplified process of refunding, handling void transactions and partial payment captures, while enabling faster issue resolution and reducing operational delays when orders change or disputes arise.

For businesses operating across multiple channels, ensure that the gateway supports omnichannel synchronization. It offers a unified visibility across online payments. While you get a consolidated view that prevents data silos, improves reconciliation accuracy, and provides a complete view of revenue performance.

Customer self-service features, such as updating payment methods or viewing invoices, help reduce support workload and prevent revenue loss due to failed payments. These capabilities are especially critical for subscription-based businesses.

Support and reliability

Support and reliability play a critical role in keeping payment operations running smoothly. You should evaluate the support channels offered, such as 24/7 phone support, live chat, email, and ticketing systems. Payment failures or settlement issues can occur at any time, and delayed support directly impacts revenue and customer experience.

The quality of support should also be measured. A provider with a strong reputation for quick and knowledgeable assistance can significantly reduce resolution time during critical payment issues. Poor support often leads to downtime and operational inefficiencies.

Strong documentation and learning resources, including knowledge bases, implementation guides, and tutorials, help your teams to resolve issues faster and reduce dependency on support.

To ensure the reliability of the gateway, you must check its uptime SLA, with 99.9% or higher being the industry standard. Consistent uptime ensures uninterrupted transactions and protects revenue flow.

A strong disaster recovery setup, including redundant systems and failover mechanisms, ensures payments continue even during outages.

Lastly, you should review the provider’s updates and product roadmap. Going through the regular feature releases and transparent plans indicates long-term stability and the ability to adapt to evolving payment and compliance requirements.

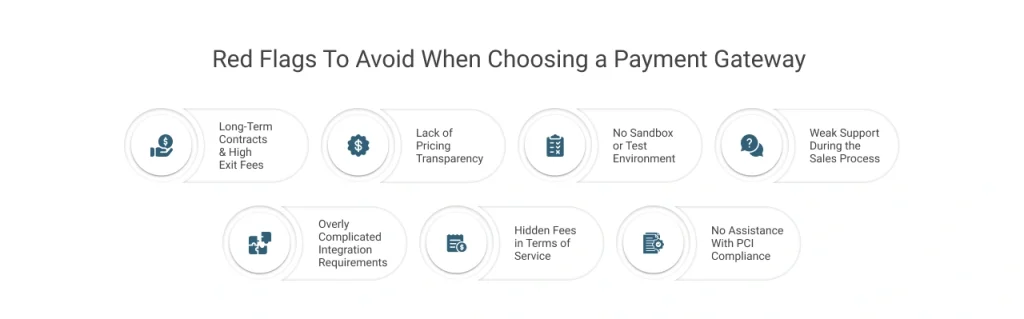

Red flags to watch out for before you choose the right payment gateway

Before you go by selecting a payment gateway, spotting warning signs early can save your business from future hassles and unnecessary costs. We’ll discuss a few pointers that you should definitely avoid.

1. Pressure to sign long-term contracts with hefty ETFs

One major red flag is pressure to sign long-term contracts with hefty early termination fees (ETFs). Providers that lock you into lengthy commitments with penalties make it difficult to switch if their service doesn’t meet performance or pricing expectations. This limits flexibility as your business evolves.

2. Unwillingness to provide complete pricing in writing

Another concern is when a provider is unwilling to provide complete pricing in writing. Transparent pricing should cover all fees, including the transaction rates, monthly minimums, chargeback fees, and any extras. Without written clarity, you may end up with unexpected charges that can erode profitability.

3. No sandbox/test environment available

A reliable payment gateway should offer a sandbox or test environment for developers. If a provider doesn’t offer this, you won’t be able to safely validate your integration before going live. This increases the risk of live transaction errors that can affect customer experience and revenue.

4. Poor support responses during the sales process

Watch for poor support responsiveness during the sales process. Perform early interactions and test the service quality. If the service seems to be slow or you get unhelpful responses, this may indicate ongoing support challenges. You might also face real issues post-integration.

5. Overly complex integration for your needs

Overly complex integration requirements that don’t match your technical capacity or business needs can delay launch and increase development costs.

6. Hidden fees are buried in the terms of service

Some payment gateways charge fees for services that should be included or given complimentary. Or, they might have confusing fee structures that only become clear after you start using them. These costs can unexpectedly reduce your profits.

7. No PCI compliance assistance

Be careful if a provider doesn’t help with PCI compliance and instead tells you it’s upto you. A gateway that assists with compliance helps reduce risks and makes it easier for you to meet these standards. If they don’t support compliance, you could face security issues and fines.

How to choose a payment processor that suits your business needs the best?

Here, we have provided a checklist on how to choose the right payment gateway for your business.

Self-assess your needs for a payment processor

Perform a thoughtful self-assessment of your business needs. This helps lay a foundation for a smart selection decision.

Start by analysing the processing volume you require. The total amount you handle monthly or annually directly affects your costs and scalability.

Processors are priced differently based on volume. Some offer tiered discounts as volume rises, while others might struggle to maintain speed and uptime at scale. Therefore, be your transaction volume low or high, whatever the case is, selecting a processor with proven high-volume performance and clear cost efficiencies can protect margins and service quality as you expand.

The size of each transaction is important because it affects costs and the kind of risk the payment processor takes on. Smaller, frequent purchases (like those under $50) are typical in retail and fast-moving consumer goods. These transactions often benefit from processors that have low fees and are designed for micro-transactions. On the other hand, larger purchases (over $500) need stronger fraud detection and better underwriting since they involve more money at risk. Choosing a processor that aligns with your average transaction size can help prevent unexpected fees or declines.

Industry focus comes next. Think about whether you need a processor that focuses on your industry. Some processors specialize in areas like SaaS, restaurants, nonprofits, or retail. They are built in a way to understand the specific payment behaviors, compliance needs, and integration requirements of those sectors. For example, businesses using Salesforce might require a processor that is native to the platform. Therefore, ChargeOn, which is 100% Salesforce native, offers features that are much more relevant to businesses using Salesforce.

Financial terms and pricing

When choosing a payment processor for your business, financial terms and pricing structure requires extra attention. Many processors advertise attractive rates upfront, but the real cost is often hidden. Therefore, review each pricing component carefully to avoid surprises, compare vendors fairly, and protect your margins.

Understand the processor’s pricing model. These could vary as:

- Interchange-plus pricing is usually the most transparent because you pay the actual card network cost plus a fixed markup.

- Tiered or blended pricing groups transactions into buckets, which often hides true costs and increases fees for certain transaction types.

- Flat-rate pricing is simple and predictable, but can be expensive at scale.

You must choose a model that balances clarity, cost control, and transaction volume.

Monthly minimum fee

Some processors require you to process a minimum dollar amount in fees each month. If you don’t meet it, you pay the difference. Knowing how this fee is calculated helps you evaluate whether the processor aligns with your revenue patterns.

Monthly statement or service fee

This is a recurring fee charged for account maintenance, reporting, or access to the payment platform. While it may seem small, it adds up annually. You should confirm with the provider what services are included and whether you truly need them, or if the fee is simply a baseline cost.

PCI compliance fee

Processors may charge a PCI compliance fee to cover security tools, audits, or compliance assistance. It’s important to confirm what this fee includes, such as vulnerability scans or compliance support. Ensure that you are not paying extra later for mandatory security requirements.

Early termination fee

Some payment processor providers penalize you for ending the agreement early. These fees can be significant and limit your ability to switch providers if service quality drops. Understanding the amount and conditions helps avoid vendor lock-in.

Contract length and auto-renewal terms

Payment processors may offer month-to-month, annual, or multi-year contracts. If the contract is longer, it often minimizes the rate but restricts flexibility.

Some auto-renewal clauses in your contract can extend the contract duration unless you cancel within a specific notice period. Therefore, knowing these clauses and terms is essential.

Risk management and funding

Risk management and funding factors directly impact how fast you can start accepting payments and how much of your money is accessible.

Underwriting and approvals determine how quickly your processor allows you to go live. Long approval cycles can delay product launches, go-live dates, or revenue collection. Therefore, understanding the documentation required upfront, such as business registration, bank statements, or processing history, helps you avoid last-minute hassle. You should also review industry restrictions closely, as some processors have strict rules around high-risk or regulated industries.

Funding and settlements define how reliably and quickly you receive your money. The deposit schedule, be it next-day, two to three days, or weekly, affects your working capital and daily operations.

The ability to use multiple bank accounts helps you split funds for accounting, regional operations, or compliance needs.

Weekend and holiday funding policies matter for businesses with continuous sales. Therefore, delays during non-business days can create short-term cash gaps.

Fraud and compliance support

Strong fraud prevention is an important aspect for protecting revenue and reducing chargebacks. You must look for built-in fraud tools like velocity checks, IP geolocation, and BIN or ISP monitoring. These automatically flag suspicious transactions early, helping prevent fraud before it impacts your business.

Processors that offer chargeback alerts notify you early when a dispute arises. It allows you to respond quickly and helps lower chargeback rates.

On the security side, assess the processor’s PCI DSS support to understand how much compliance responsibility is reduced for your business. Clear data breach liability coverage is also important, so you know who bears the risk if a breach occurs.

Ensure the processor follows strong encryption standards and provides tokenization at the processor level. These protect sensitive payment data and enable safer recurring and repeat transactions.

Technical integration

A payment processor should integrate easily with your existing systems to avoid development delays and ongoing maintenance issues. Ensure that you get clear and well-documented APIs that help your teams to integrate faster and reduce errors.

You must also check gateway compatibility early. Some processors require using their own gateway, while others support multiple gateways. This impacts flexibility, future expansion, and vendor lock-in. Reviewing preferred or pre-integrated gateways helps ensure smoother operations, and understanding any additional fees for non-preferred gateways prevents unexpected costs later.

It is a plus if the processor offers reporting and management capabilities. A processor should offer real-time dashboards, easy data exports, and basic customization for reports. Role-based access ensures secure collaboration across teams, and mobile-friendly monitoring allows quick visibility into payment performance when teams are on the move.

Service and support

Service and support are important factors because payment issues directly impact cash flow and customer trust. Therefore, a strong support mechanism ensures assistance when something goes wrong. You are not left waiting while transactions fail or money gets stuck.

Ensure the provider offers 24/7 support. It is important if you operate across time zones or run subscriptions and recurring payments.

Look for the contact methods like phone, email, chat, or ticketing systems so you can reach out to them through the fastest channel during urgent issues. Ask about average response times for different issue types, be it technical, billing, disputes, or others, and confirm whether there’s a clear escalation path if an issue isn’t resolved quickly.

Red flags to avoid while selecting a payment processor for your business

Before selecting a payment processor, notice these red flags among the providers available in the market. Here are a few pointers that you should definitely avoid.

1. Requires a multi-year contract with a high termination fee

If a processor locks you into a long-term contract, it limits your flexibility. Payment needs change as your business grows. Therefore, if the payment processor is not supporting your scalability and you plan to exit, it shouldn’t cost you heavily.

2. Unwilling to provide all fees in writing upfront

Lack of fee transparency is a major warning sign. If the pricing details aren’t clearly documented, hidden charges can surface later in the form of unexpected deductions, monthly fees, or compliance costs.

3. Negative reviews

If you see negative reviews across platforms for the processor, related to delayed payouts or frozen funds, this indicates operational or trust issues.

4. Sales reps avoid technical questions or push for immediate signatures

A processor provider should be comfortable answering technical questions about integrations, security, compliance, and settlement timelines. Pressure tactics or vague answers usually mean gaps in service or terms.

A quick payment gateway checklist and a payment processor checklist

| Quick Payment Gateway Checklist | Quick Payment Processor Checklist | ||

|---|---|---|---|

| Basis | Checklist | Basis | Checklist |

| Business and Use-Case Fit |

|

Business Assessment |

|

| Cost and Pricing Structure |

|

Pricing and Financial Terms |

|

| Technical Compatibility |

|

Risk Management and Funding |

|

| Security, Compliance, and Risk |

|

Fraud and Compliance Support |

|

| User Experience and Operations |

|

Technical Integration |

|

| Support and Reliability |

|

Service and Support |

|

Avoid these red flags and select the vendor that ticks almost all these checkboxes for payment gateway and payment processor. This way, you have made the right decision for your business.

To ease your search for a payment processor solution, we introduce you to ChargeOn, one of the top payment processing providers. It checks all the checkboxes above, making it the right solution for your business.