Table of Contents

As an e-commerce business, you must be dealing in digital payments and might have heard terms like ‘payment gateways’ Vs. ‘payment processors’.

These technologies help streamline the online payment process, resulting in the efficient transfer of money from the issuing bank to the receiving bank.

But why have we addressed them differently, though they might sound similar to you? This is because they differ based on their functionality and working.

Thus, this blog will help you to eliminate your confusion and grasp insights into both these technologies and how they differ.

Let’s get started!

What is a Payment Gateway?

It acts as a digital cashier with various payment modes, including debit and credit cards, ACH payments, and digital wallets like Apple Pay, Google Pay, etc., and net banking. Customers get various payment options all in one place.

It gathers customer payment details from the merchant’s site, verifies them, and then forwards the information to the payment processor for processing.

It is like a third person who guarantees a verified and truthful transaction between the customer’s bank and the merchant’s payment portal.

Consider a situation where customers consider a payment option that benefits them the most. It benefits security, convenience, automated payments, and whatnot!

But what if your e-commerce storefront is missing its favourite payment method? According to Zippia, 7% of shoppers leave their online shopping carts because their preferred payment method is not available.

Not a good reason to let go of customers, right?

This is where Payment Gateway is needed to provide customers with multiple payment options from which they can opt for their favourite.

What is a Payment Processor?

After receiving the information from the payment gateway, the payment processor executes the further transfer. It transfers funds from the customer’s issuing bank to the merchant’s acquiring bank by following a secure, predefined approach.

Additionally, it addresses security concerns by employing advanced measures such as encryption and tokenization. Many algorithms and fraud detection tools are responsible for detecting any mishap that might result in financial loss in advance and preventing them.

Moreover, you cannot do without a Payment Processor; it is a must for your e-commerce business.

Now that we know what both technologies are, let’s understand the online transaction process.

How Do Payment Processors and Payment Gateways Ensure a Smooth and Secure Transaction Process?

1. Starting the Transaction:

Initially, the customer chooses a product, adds it to the cart, and proceeds to checkout.

2. Payment Gateway’s Involvement:

When the customer is at the checkout and ready to pay, the payment gateway collects and encrypts the customer’s payment information for security reasons.

3. Communication with the Payment Processor:

The Gateway then communicates with the processor by transferring the encrypted data.

4. Processor Authorization:

Moving on, the processor receives this data and verifies and authorizes the same with the issuing and receiving bank before moving forward. While interacting with both the banks, and after verification, it checks for available funds and proceeds for a secure transaction.

5. Transaction Approval or Declining:

Based on the information the issuing bank shares, the payment processor decides whether to approve the transaction or decline it.

6. Feedback to Gateway:

After the confirmation, the status is shared with the payment gateway and further, it is shared with the online platform.

7. Customer and Merchant Notification:

The merchant receives the confirmation of the purchase to proceed with fulfilling the order. As well as the customer is also notified of the same.

8. Settlement of Funds:

The payment processor oversees the transfer of funds from the customer’s account to the merchant’s account.

9. Transaction Completion:

At last, the customer and the merchant have a transaction record, which also acts as proof. This record includes information such as transaction amount, date, time, payment method used by the customer, and the status of the transaction.

This whole process takes only a few seconds or minutes to complete, allowing a hassle-free transaction experience.

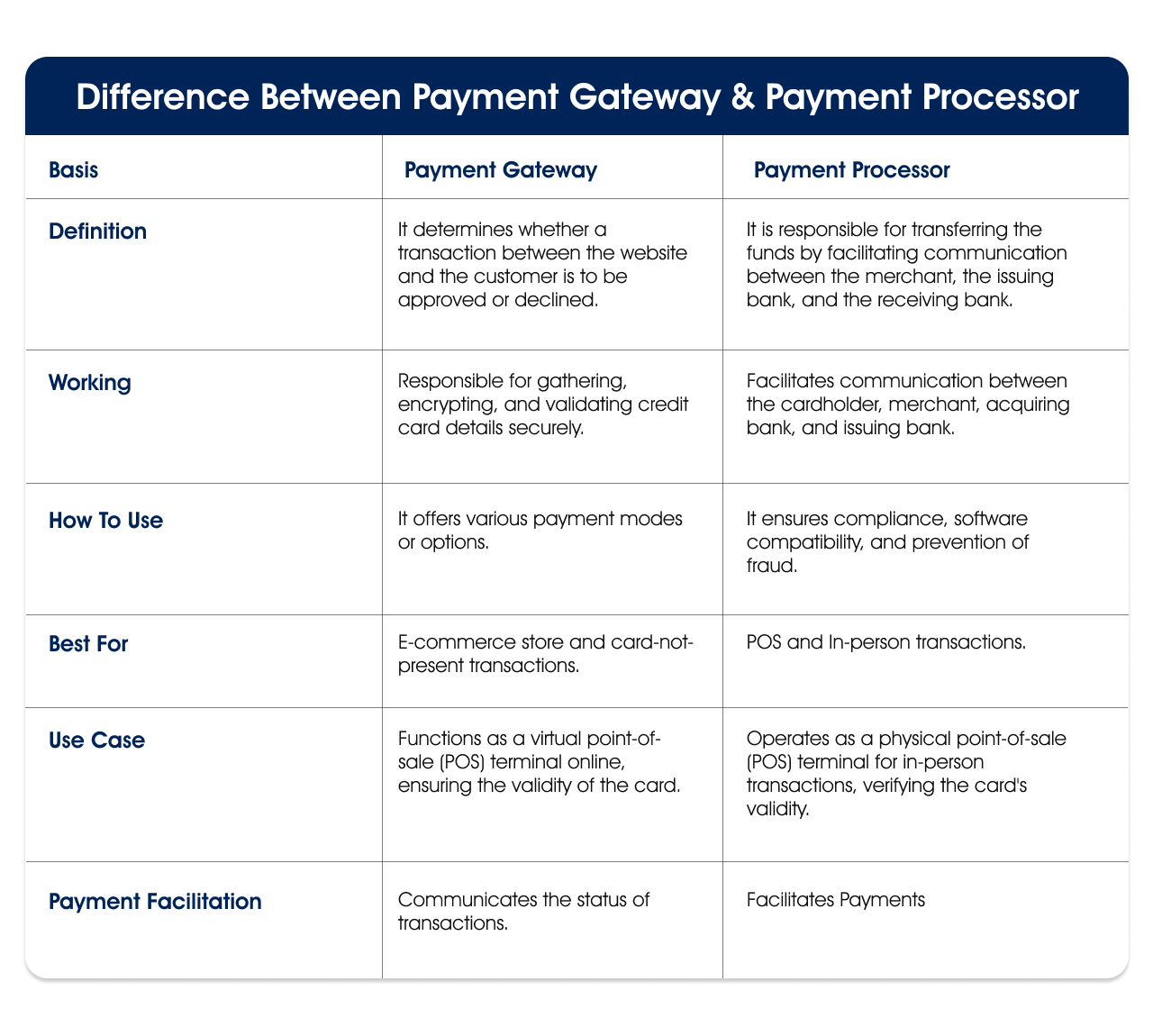

Payment Gateway vs. Payment Processor: the Ultimate Differences

Both technologies are essential for a business to leverage a smooth transaction process. Many people confuse them as being the same technology. But they differ from each other on a few terms. Therefore, we have listed the points, stating the differences between Payment Gateway and Processor

How is ChargeOn Helpful?

Many businesses use multiple payment gateways for various reasons, such as the unavailability of a specific gateway in a particular country, expanding their geographic reach, or accepting payments in multiple currencies.

However, managing data from multiple gateway platforms can be a challenging task. Therefore, this is where ChargeOn can help you by allowing multiple gateway integration in a single space.

It is a 100% native AppExchange application that seamlessly connects your Salesforce platform and Payment gateways. You no longer require multiple third-party payment processors; just choose ChargeOn and streamline your Salesforce payment processing.

Here, we’ve compiled a summary of the various features that it offers:

- Receive payment all across the globe through multi-currency support.

- 360-degree customer view for all customer interactions.

- Easy point-and-click setup.

- Instant and scheduled payments

- Manages all your recurring payments

- Automated payment collection

- 14+ payment gateway integration support

- Automatic reminders and notifications allow real-time updation for successful and declined transactions and other events.

- Tokenization allows secure and seamless payment processing.

- Track your transaction volumes and counts with reports and dashboards.

- Charge, authorize, and partially refund payments using connecting keys.

In a Nutshell

Payment gateways and payment processors work interconnectedly but perform distinguished functions. Therefore, knowing the difference between both is essential for businesses.

Payment gateways are useful when you want to offer your customers a user-friendly interface to enter payment information.

It handles the front-end process by seamlessly integrating with websites and online stores to enable smooth online transactions. You can opt for it when you want a customized payment solution for your business needs.

Payment processors support the back end of the transaction process. You can leverage it when you need a service to manage the entire transaction process, from authorization to settlement.

It offers various payment services, such as handling different currencies and providing detailed transaction reports.

Do these features not appear remarkably similar? Indeed, they do as ChargeOn offers you the same functionalities.